Who thinks a $900,000 starter home is normal?

The Liberal’s latest press release shows bourgeoisie thinking that rivals the reign of Louis XVI.

Canada's housing supply shortage now sits near the top of Canadian's list of most important issues, and Canadian Prime Minister Justin Trudeau is facing massive pressure to develop a meaningful response from his Liberal federal government.

However, even after shuffling his cabinet this summer, the Liberals are struggling not only to develop a concrete plan to show progress but also to show that they understand the severity of the problem - a point laid bare in a press release issued last week by newly minted Liberal Immigration Minister Marc Miller to promote the federal government's First Home Savings Account.

In the release, Miller included a hypothetical example wherein a fictional couple, each grossing between $70-$100k per year, sock away $8000 of their after-tax yearly income for five years into the account. The net result for the couple in Miller's hypothetical example was this:

"They use their First Home Savings Account as a 10% down payment to qualify for a mortgage and purchase their first home for $900,000."

The absurdity of the example in Miller's statement is multifaceted and should raise further concerns about the thinking behind the federal government's grasp, or lack thereof, of just how bad the situation is.

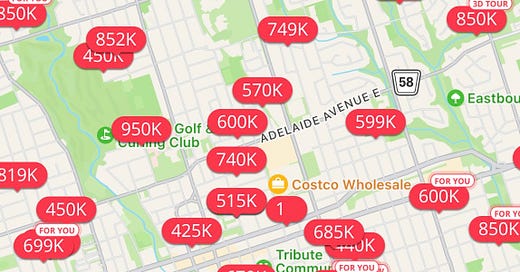

For starters, the federal Liberal government seems to have rationalized that paying $900K for a first home is normal. Which, in turn, suggests the federal Liberals seem to have resigned themselves to merely tinkering around the edge causes of Canadian housing unaffordability instead of acknowledging their existence or developing a plan to address them.

That's hugely problematic - both morally and politically - for several reasons.

It demonstrates a complete ignorance of the crushing reality of the unaffordability of the Canadian housing market, even for Canadians making what should be, by all accounts, an excellent salary. Circumstances are so grim that the Toronto Star reported families earning $100,000 in Toronto are now eligible for assistance from Habitat for Humanity - a charity that builds shelter for underprivileged persons. And a Mayor in the Waterloo region has said that despite earning $90,000 per year, she has to live with her parents because she can't afford housing in the area she represents. If people in those income brackets can't afford housing, the Liberals should ask themselves who can.

Further, in suggesting that it's the Canadian's job to save harder as opposed to the government's role to close the vast delta between housing supply and rapidly increasing demand, a justifiable anger is being engendered among the public. The reality for millions of Canadians is that it is not even in the realm of possibility to save hard enough to meet the ever-rising tide of vomit-inducing housing costs.

Take, for example, the hypothetical couple in Miller's example. That the federal Liberals expect a couple making somewhere in the neighbourhood of $150k per year to save $16k per year of after-tax income every year for five years is not even in the realm of possibility for most. It's not like the Liberals don't have evidence to draw from to prove this fact. A recent report from Statistics Canada stated that in 2021 the median after-tax income of Canadian families and unattached individuals was $68,400. This statistic, coupled with soaring housing and rent prices and generationally high-interest rates, has translated into a trend that has seen many Canadians spends well above the traditional safety threshold of 30% of their income on housing expenditures.

Add rampant food and fuel inflation costs, student loan payments, and car payments to the mix, and Miller's ask to that Canadian couple to put away around $1300 a month to save for a 10% down payment on a $900K house, is bourgeoisie thinking that rivals the reign of Louis XVI. Assuming that Miller's fictional couple even qualify for that level of mortgage at that point, they would then trade that downpayment for (assuming a 5-year fixed mortgage at an interest rate of around the current rate of 6%) a mortgage payment upwards of $5,400. This math suggests the Liberals think Miller's hypothetical couple, again making about $150k pre-tax per year, would be okay spending upwards of 60% of their average monthly take-home income on their mortgage.

That is insane.

Miller's press release wasn't some accident. Those sorts of things go through multiple rounds of review and often require signoff from the Ministers themselves. It’s virtually guaranteed that someone ran these figures and thought they were reasonable. The federal government needs to reject this style of thinking that feels like it was concocted on a lazy afternoon in the Petit Trianon by bonbon-eating courtesans instead of by politicians who give a damn.

Continuing with a "let them eat cake" approach to starter homes will only worsen social problems like crime, addiction, violence, and mental health issues - a trend no Canadian can afford.